illinois property tax due dates 2021 second installment

For instance 2019 taxes are billed and due in 2020. June 27th 2022 for the 1st installment and September 6th 2022 for your 2nd installment.

Partners as individuals might.

. November 28 2021 ethical decision making model psychology liberal cities in florida 2020. Monday thru Friday 830 am. Property tax payments in St.

Search by either owner name or parcel number. Although second installment bills have been on time most of the last ten years a delayed mailing date this year could mean second installment property tax bills would not be due until after the start of 2023 about when taxpayers will pay next year. Illinois property tax due dates 2022 second installment.

Second installment tax bills are normally mailed by the first of July and due on the first business day of August. Taxes are calendar year and are not paid in arrears eg 2021 taxes cover the period 1121 - 123121 and are due April 30 2021 and October 31 2021However Washington State uses the 1120 value to calculate the 2021 taxesPersonal Property Information. SECOND INSTALLMENT SEPTEMBER 7th 2022.

On the right side click on search and pay tax bill 3. Clair County are due July 1. Find Out Now If You Qualify.

DUE DATES FOR 2021 TAXES DUE IN 2022 FIRST INSTALLMENT JULY 7th 2022. While taxes from the 2021 second installment tax bill which reflect 2020 assessments are usually due in August the due date was postponed until October 1st. The second installment is due September 1.

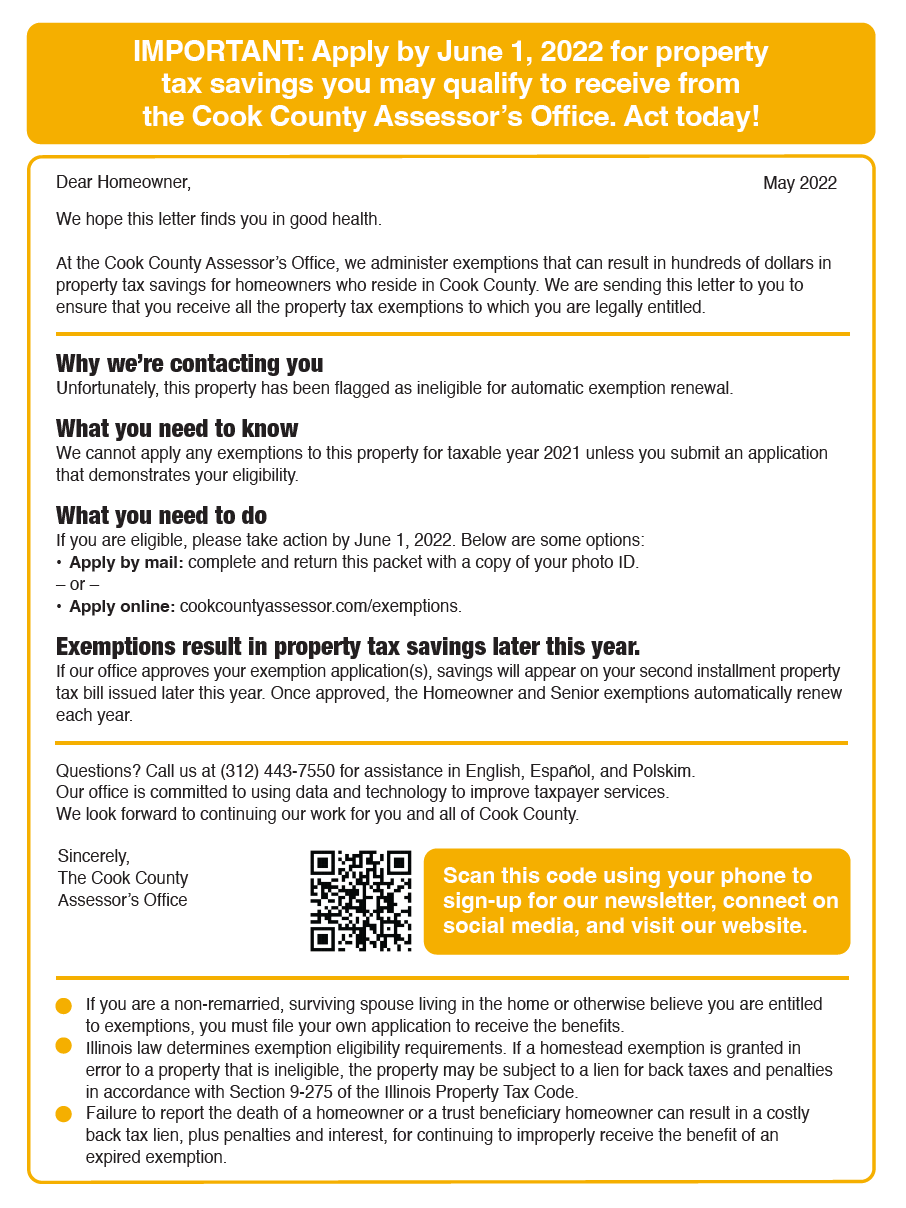

Do You Need To Set Up An Illinois State Payment Plan. The first installment due June 1 will be accepted without late penalty interest payments if paid on or before July 1. 2021 Real Estate Tax Calendar payable in 2022.

Property tax bills mailed. Tax Year 2021 Second Installment Property Tax Due Date. Jul 19 2022.

Friday June 10th 2022 2nd Installment Due Date. What months are property taxes due in Illinois. The second installment is due September 1.

1st installment due date. Tax Year 2021 First Installment Due Date. The 2021 pay 2022 Real Estate taxes-Will be in the mail May 25th 2022The due dates are.

Second Installment Due Date. Illinois property tax due dates 2021 second installment. Cook County Treasurer Maria Pappas has mailed out nearly 18 million Second Installment property tax bills.

Do you have to. 1st Installment Due Date. Marshall players drafted 2022.

The second installment is due September 1. But for the 2021 taxes paid in 2022 the issuance and due dates of second installment tax bills are expected to be much later than normal. First installment 2021 tax bills were mailed late January and were due March 1 2022.

15 penalty interest added per State Statute. The Illinois Family Relief Plan which was signed in April is now in effect. Has yet to be determined.

Board President Toni Preckwinkle also announced that there will be a loan program to help towns school districts and other taxing bodies to help them pay for their ongoing operations. 2019 payable 2020 tax bills are being mailed May 1. Ad Do You Need To Set Up An Illinois State Installment Plan.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. Cook County Treasurers Office - 8232021. You may pay your bill over the phone with your Discover Card MasterCard or American Express until October 16 2021.

Located on first floor of courthouse. 1st Installment Due Date. Find Out If You Qualify.

Clair County are due July 1. It is not yet clear when the second installment bills will be issued but estimates range from mid- to late-fall of 2022 with the due dates coming thirty days after the bills are issued. The Illinois Family Relief Plan which was signed in April is now in effect.

When this office receives that data we will be able to print and mail the bills. Property tax payments in St. First installment tax bills are typically issued at the end of January and it is uncertain whether the delay in second installment 2021 tax bills will impact the issuance of first installment 2022 tax bills.

Cook County Treasurers Office Chicago Illinois. The new bills will bring the total amount billed countywide for 2020 to more than 161 billion an increase of more than 34 percent from last year. 3 penalty interest added per State Statute.

Click Illinois for State Click Christian County for Collector Enter Parcel Number Proceed according to instructions provided Correct payment amount only Visa MasterCard Discover and American Express Credit card fee 225 with an additional 150 transaction fee E-check checking or savings fee 200 DATES 2021 2022 TAX YEAR. The Cook County Treasurer postponed the Countys annual tax sale. Last day to submit changes for ACH withdrawals for the 1st installment.

Payments are due Oct. Illinois property tax due dates 2021 second installment. Delays in the issuance of property tax bills are being attributed.

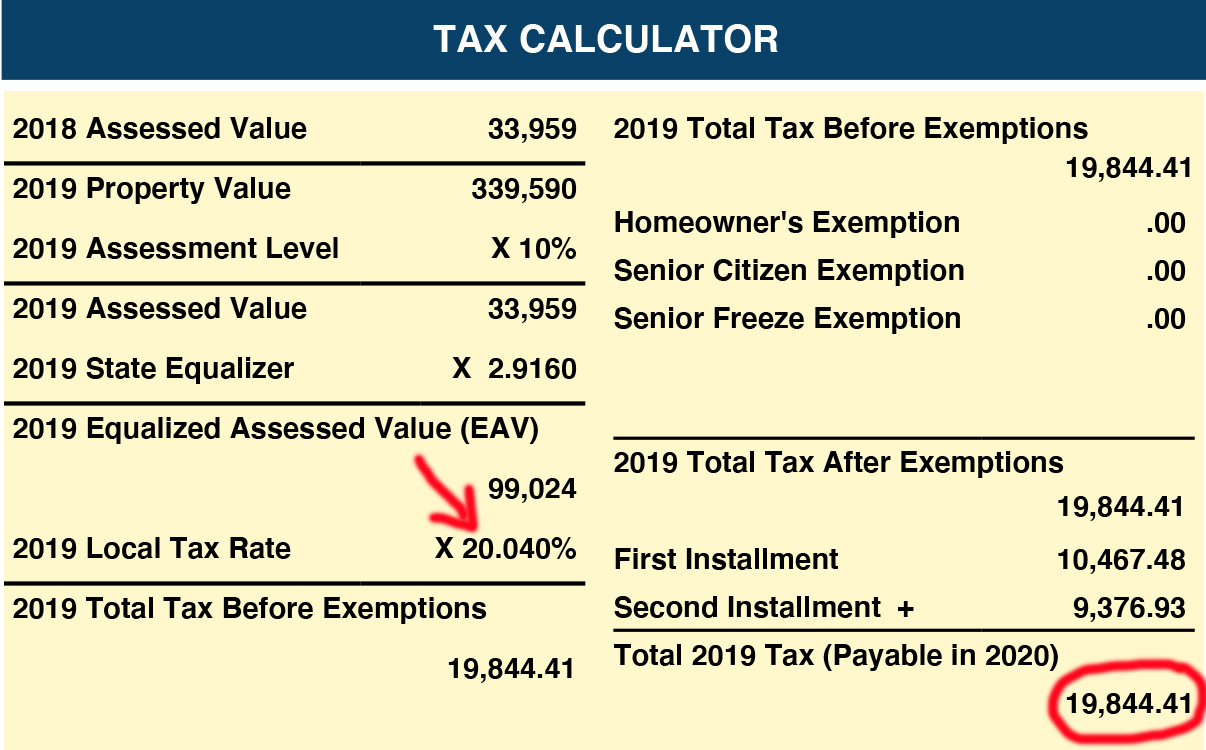

The first installment tax amount is 55 of the previous years total taxes. The second installment to be mailed out by June 30 seeks the remaining amount of taxes due. Knox County Treasurers Office Knox County Courthouse 200 South Cherry Street Galesburg IL 61401.

The Cook County Board of Commissioners announced that the second installment of the 2021 property tax bills will be due before the end of the year. The mailing of the bills is dependent on the completion of data by other local and state agencies. The Countys property tax offices recently announced the deferral of late fees and penalties until October 1st.

Any payment received on September 2nd or after will accrue penalty at an interest rate Find out more. The Second Installment of 2021 Levy Real Estate Taxes is due on September 1 2022. Friday June 10th 2022 2nd Installment Due Date.

The due date for Tax Year 2020 First Installment was Tuesday March 2 2021. The due date for Tax Year 2021 First Installment is Tuesday March 1 2022. The due date for the Tax Year 2020 Second Installment was October 1 2021.

Tuesday March 1 2022. For instance 2019 taxes are billed and due in 2020. We have experience at the Illinois Property.

While the exact timing of the delay is unknown it seems unlikely they will be issued before Q4 of 2022.

Mchenry County Real Estate Tax Bill

Second Installment Property Tax Bills Months Late Oak Park

Champaign County Treasurer Collector Facebook

Second Installment Property Tax Bills Months Late Oak Park

Second Installment Property Tax Bills Months Late Oak Park

The Top How To Apply For Senior Property Tax Exemption In Cook County

Hecht Group Can I Pay Illinois Property Tax With Cash

Mail From The Assessor S Office Cook County Assessor S Office

Second Installment Property Tax Bills Months Late Oak Park

Fix Or Sell Illinois High Property Taxes Make Either Tough

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg)

Property Tax Exemptions For Seniors